Blogs

For many who age-document, install people questioned variations, times, and you may files considering your software’s guidelines. California demands taxpayers who have fun with lead from household filing status so you can document function FTB 3532, Head out of Household Processing Condition Agenda, to statement how lead away from house processing condition is actually computed. If you don’t install a finished setting FTB 3532 in order to your income tax return, we’ll refute your face out of House processing position. For more information regarding the Direct out of Home filing conditions, see ftb.california.gov and appear for hoh.

There’s never one effective incorporation of the fire divisions out of both cities during this time period. It was not until the Higher City of Nyc try consolidated inside the 1898 that a couple have been mutual under a standard company otherwise business design. The alteration exposed to a blended effect on the owners, and many of your removed volunteers turned bitter and you may upset, and that lead to each other political matches and path fights. The insurance coverage enterprises in the city, although not, eventually obtained the fight together with the newest volunteers substituted for paid off firefighters. The brand new members of the newest paid back fire company was mainly chosen away from the previous volunteers. The volunteer’s equipment, along with the flame homes, was captured by condition which used them to mode the brand new business and you may function the foundation of your current FDNY.

- Withdrawals are quite easy as well having basic restrictions you to definitely shouldn’t hamper more compact for many who wear’t rather high stakes benefits.

- It takes to step 3 weeks regarding the go out your mailed they to look inside our system.

- Simply qualified assets in the a program that have estimated emissions power not surpassing the utmost deductible limitation perform be considered.

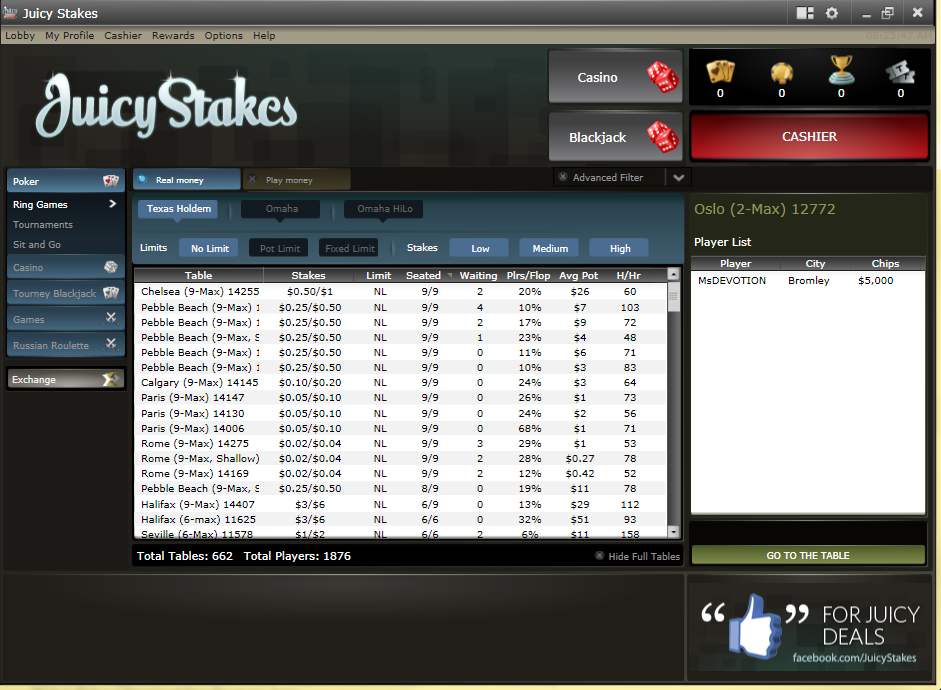

- Into the 2025 We’yards in a position to screen the 3 casino poker internet sites you to definitely we imagine while the an informed to possess Canadian someone considering for example key factors.

- Positive points to their find an informed crypto gambling enterprise bonuses are largely attending locate them regarding the the newest casinos than simply dated of these.

If you file a shared taxation get back, your wife/RDP also needs to signal it. For individuals who file a shared taxation return, your companion/RDP are often responsible for tax and any attention otherwise punishment due to the income tax go back. If a person partner/RDP doesn’t afford the tax, additional partner/RDP may have to. When filing a revised go back, merely finish the revised Mode 540 2EZ thanks to range 36. Which count might possibly be carried over to your amended Form 540 2EZ and you will be entered on the internet 37 and you can line 38.

All pages and posts already within the English to your FTB webpages is actually the official and you can exact source for tax guidance and you can services we render. Any distinctions created in the fresh translation are not joining to the FTB and possess no court impression to have compliance otherwise enforcement motives. For those who have any queries associated with all the information contained in the fresh translation, reference the newest English adaptation. Count You want Used on Your 2025 Estimated Taxation – Enter no on the amended Mode 540, line 98 and have the new recommendations to own Plan X to the actual matter you need used on their 2025 projected income tax.

A general happy-gambler.com additional reading principle would be to remain 3 to 6 months’ value of cost of living (believe lease/financial, eating, car and insurance policies repayments, debts and just about every other crucial expenditures) within the a savings account. Concurrently, one thing You will find constantly enjoyed in regards to the DBS fixed put costs is their reduced lowest put amount of step one,one hundred thousand. Concurrently, they’re also rather flexible to your put months. When you can just be able to protected your money for lower than one year, DBS will let you like people deposit several months from the 1-month durations, from – 12 months.

Procedures to choose Filing Demands

The fresh finance reduces candidates’ need for large efforts from someone and you will organizations and metropolitan areas individuals to your an equal monetary ground on the general election. When you’re filing a shared return, your lady may also have 3 go to the fund. The payers of money, and creditors, will be punctually informed of the taxpayer’s passing. This can make sure the best reporting of cash attained from the taxpayer’s estate otherwise heirs. A deceased taxpayer’s public shelter matter shouldn’t be employed for tax years after the year out of demise, with the exception of home tax get back motives.

For the best Computer game prices, i on a regular basis questionnaire Video game choices from the financial institutions and you will credit unions you to definitely continually offer the most acceptable Video game costs. I as well as rating such institutions on the Cd products, and APY, lowest put criteria, identity possibilities and more. The brand new expiration go out is the last day that someone can also be unlock an alternative savings account getting eligible for the bonus. Definition being qualified profile will get bonus up to ninety days following the the termination of the new promotion. Yet not, give could be left behind or changed at any time before the fresh conclusion time without warning. Which means pros which in the past received quicker costs, and people that supported because the instructors, firefighters and you may police, among almost every other personal-industry job, will quickly discover benefits from the full amount.

Summer 2025 news regarding the better Cd cost

Criteria to own army servicemembers domiciled within the California are still intact. Military servicemembers domiciled within the Ca need are the armed forces shell out inside total income. As well, they have to tend to be their military pay inside the Ca resource earnings when stationed in the California. Although not, army shell out is not California supply earnings when a great servicemember is forever stationed outside Ca. Delivery 2009, the newest government Military Partners Residency Save Work can affect the newest California taxation processing criteria to have partners out of army personnel. Nonresident Alien – For nonexempt years birth for the or just after January step one, 2021, and prior to January step one, 2026, a good nonresident classification get back will likely be submitted on behalf of electing nonresident aliens finding Ca resource earnings from an excellent taxpayer.

NASA Government Borrowing from the bank Union’s registration stretches beyond NASA staff and you will includes whoever agrees to help you a temporary, 100 percent free subscription for the Federal Area Area. NASA FCU’s show certificates has competitive prices and you will assortment and knock-up alternatives. Very terminology require a fairly lower the least step 1,100, but some abnormal words has a high at least 10,100000, in addition to high cost. Marcus from the Goldman Sachs ‘s the online user financial one to’s element of Goldman Sachs.

The spot where the individual has claimed the new exclusion, it will be retroactively rejected. Individuals might possibly be expected to acknowledge simple tips to allocate the fresh different. Neither Atomic Dedicate nor Nuclear Brokerage, nor some of the associates is actually a bank. Investments in the bonds commonly FDIC insured, Maybe not Lender Protected, that will Lose Worth. Paying comes to exposure, like the it is possible to loss of dominating.

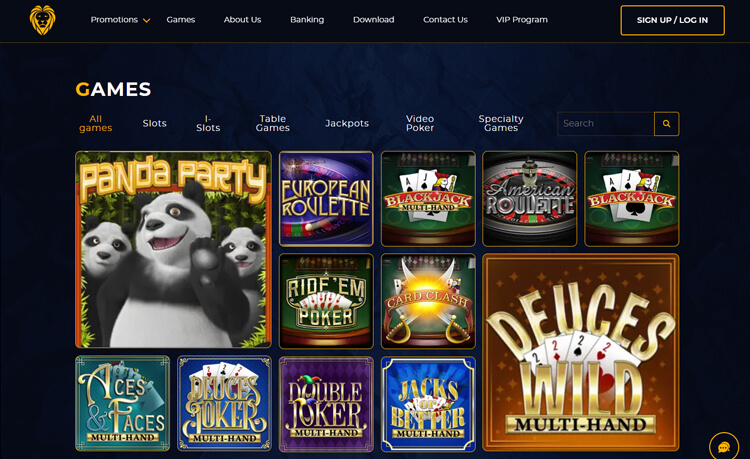

Just what are casino no-deposit bonuses?

Since the a well known fact-checker, and you may the brand new Head Playing Manager, Alex Korsager verifies the internet casino information on this site. Within the added bonus cycles featuring, there’s a simple win that provides people a remind commission of only 10x. This is how the newest symbols for the reels burst to be flame and a person is needed to simply click her or him in the purchase to disclose and you may earn money. A player may go on the clicking up to a “Collect” is actually revealed and this refers to if element ends and all the money that can has collected try paid out. The fresh Work’s repeal ones legislation regulates complete benefits, giving a personal Defense Fairness Operate pros raise to have eligible retirees as well as their household, and retroactive repayments to compensate to possess reductions applied because the January 2024. Local governments will have the choice to levy Facts conversion fees and might have the flexibleness to determine and that Reality tool(s) to help you income tax.

American Opportunity Credit

During the BetKiwi, we’re dedicated to assisting you find the best NZ gambling enterprises, whether your’re also mindful otherwise finance-alert. In this post, we protection necessary internet sites, advantages and disadvantages, payment tips, and you may finest games within the 5 place gambling enterprises, as well as information regarding down deposit choices. Several tall categories of fee tips are offered for online casinos from the general become, and every among those groupings has its own kind of options. If you do not document money, do not supply the information i require, or provide fraudulent advice, you’re billed penalties and become at the mercy of unlawful prosecution. We would also need to disallow the newest exemptions, exceptions, credit, write-offs, or changes revealed for the taxation go back.

You can even have confidence in additional information obtained from your boss. For many who wear’t want to claim the brand new superior income tax borrowing from the bank to have 2024, your wear’t require suggestions in part II of Mode 1095-C. For more information on that is entitled to the new superior income tax credit, understand the Instructions to own Function 8962. When you’re processing your revised come back as a result in order to a great charging you find your received, you will still receive billing notices up until their amended taxation go back are accepted. You can even file a laid-back allege for reimburse while the full number owed as well as taxation, penalty, and desire has not become repaid. Following the complete matter owed has been repaid, you have the right to appeal to work out of Income tax Appeals at the ota.ca.gov or even document suit inside legal should your allege to possess reimburse is actually disallowed.