Preferably, you can utilize upwards your entire money before you leave Chicago. Foreign exchange organizations barely provide the same rate of exchange for money buy-backs as they perform for transformation. For individuals who finances really, you will have restricted bucks left after your own excursion. Purchase their left dollars, especially the gold coins, otherwise set it up aside for your upcoming stop by at the newest Says. Diligent traders that will buy now when you are prices are on the downslope could be rewarded when the pandemic fades and field pushes return to equilibrium.

Next Steps to possess Chicago Borrowers

You will find finalized millions in the hard money fund close to Chicago. Fairview just gives its own financing and you can individually structures for each exchange to suit the requirements of the newest debtor. Fairview is actually a primary difficult money-lender; once you name you are going to talk to the choice suppliers. Johnson’s arrange for large transfer taxes on the a house sales more $1 million create disproportionately apply at industrial a property, while you are lowering the commission for some home-people. The fresh import tax to own customers from a $310,one hundred thousand family, such, manage drop away from $dos,325 so you can $1,862, protecting a little less than just $five-hundred.

What is the finest marketplace for a beginner trader?

This could build property inexpensive, to make today a good time to buy Chicago18. Leasing belongings inside River Northern are performing well, having expensive apartments you to bring in thousands. Many people rent their houses right here, so it’s a fantastic choice for those who need to purchase inside the nice leasing functions. It’s close to larger web sites and will be offering an adore life, rendering it popular15. Chicago’s housing market is stuffed with opportunity to own traders.

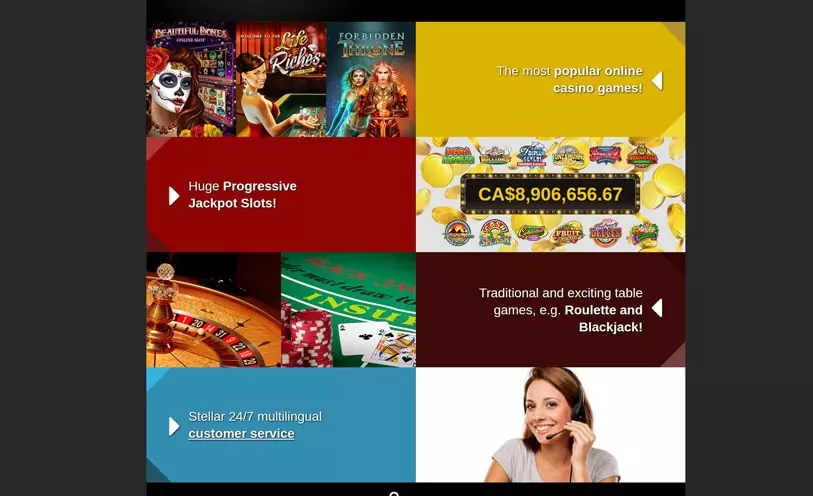

Sure, Chicago’s possessions taxes is actually above the federal average. Lincoln Rectangular https://wjpartners.com.au/money-rain-pokies/ feels like a little urban area that have loved ones fun and you can varied societies. It’s an excellent location for investors searching for a residential district-focused city. Edison Playground is an additional higher choice for investors, that have property choosing $345,364 normally, making it very safe—topping 99% of your own town in the safety12.

So it depth of knowledge and you can sense lets us financing money rapidly inside the Chicago a large number of anyone else couldn’t consider. There are many tough otherwise individual currency options one to people currently provides during the the fingertips inside now’s productive marketplaces. EquityMax is looking getting the bank that offers the new better mixture of name, rate, points, whilst reducing 3rd-party will set you back. If you discover a better package, we’re going to constantly turn to overcome the competition.

We are able to improve the following consumers making use of their IL hard currency needs:

With inactive paying systems, prospective traders not have to worry about huge off money, organization repair otherwise tracking down troublesome clients for rental. Zillow happened to be more pessimistic in regards to the Chicago housing market, predicting a dos.3% reduction in median home values over the next one year. In the 1.3% from Chicago people is actually underwater on their home loan, that is a tick higher than the newest federal mediocre of 1.1%. “Ninety-six percent away from family transformation will see a reduction in the fresh one-day a house transfer taxation that they pay since the 96% away from sales in the city out of Chicago is actually below $1 million,” he told you.

Zero Leaders protest within the Chicago: Rally facing Trump going to downtown the next day

We could offer as much as 75% of your buy and you can treatment money for a project for accredited services and buyers. At that time, Trump had paid off their fund with $99 million inside the conversion but nonetheless necessary more money to accomplish construction. Will ultimately one to year, the guy determined that his investment regarding the tower try worthless, no less than since the name is scheduled in the partnership tax rules. The newest coronavirus pandemic has generated an industry where many anyone be it’s time to pick a home. Inside the Chicago, property one’s already heading less than market price might not be lower than market well worth longer.

- Usually one to 2nd earnest money commission is 5% of the cost to have services under $1M and you may ten% of your own cost to own functions over $1M.

- List in the region are reasonable to help you lowest, and then make to own more away from a seller’s market.

- Citibank, which gives their people totally free withdrawals from the global circle from ATMs, has several twigs round the Chicago.

- This example offers a chance for a lot of time-name investment18.

- HUD, which has estimated Chicago’s homeless populace nearer to 5,3 hundred, cannot believe people who find themselves temporarily adhering to other people so you can end up being homeless.

Chicago Football

In the 1991, together with Chilmark Partners, Zell co-founded Zell/Chilmark, a $step 1 billion investment financing, to buy upset securities. The societal protection matter try so many to find a no cost precise mortgage estimate. Is also somebody live in our home in the course of the new loan? We currently provide one another home-based and you may multifamily money characteristics. The interest try functions from the Deeper Chicagoland town as well as Southern area Wisconsin and Northwest Indiana.