The text need to equal the newest taxation owed as well as desire on the go out of payment while the decided by the Internal revenue service. Information regarding the type of bond and you will shelter inside it is be purchased out of your TAC workplace. If you must get a cruising or departure permit, you should document Form 2063 or Setting 1040-C. If the certification from conformity is signed by a realtor from industry Advice Area Director, they certifies that your U.S. income tax financial obligation had been satisfied according to readily available suggestions.

Losses of considered transformation have to be taken into account to your extent if you don’t provided lower than U.S. Although not, part 1091 (concerning the disallowance out of losings for the clean transformation from inventory and you may securities) cannot implement. The internet gain that you must or even include in your revenue try smaller (although not less than zero) from the $866,one hundred thousand for those who expatriated otherwise terminated house within the 2024. In the year your expatriate, you are at the mercy of taxation online unrealized acquire (or losses) on your own possessions as if the property got offered to have the fair market price at the time just before the expatriation time (“mark-to-field tax”). So it pertains to really type of property hobbies your stored on the the new date out of relinquishment of citizenship otherwise termination of residence.

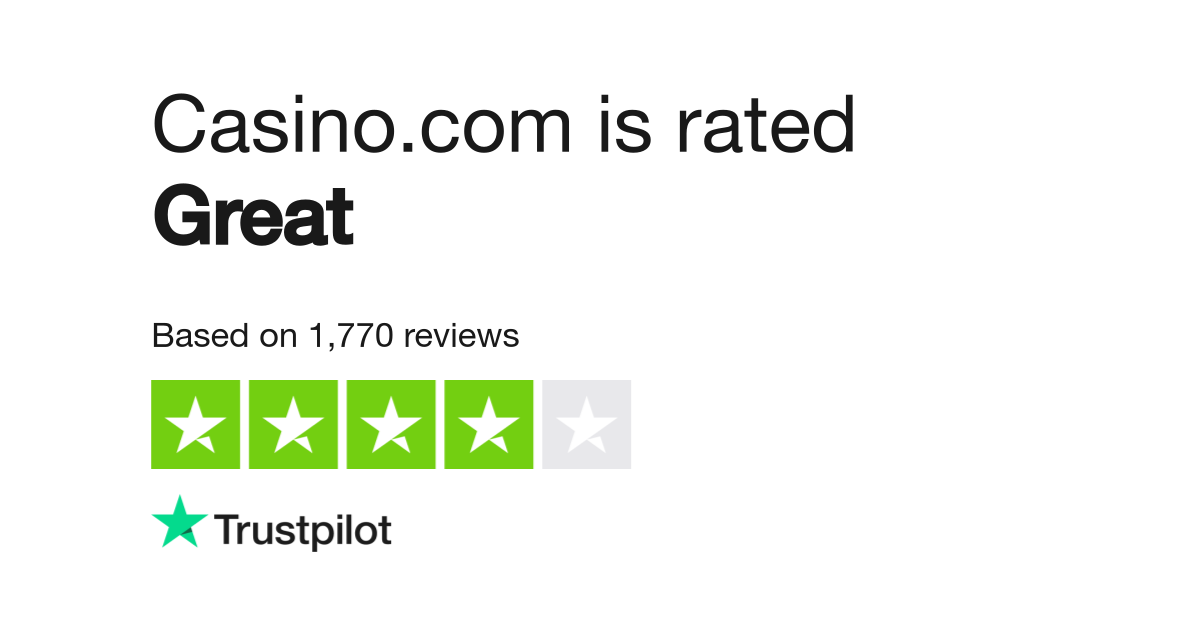

Safe and secure Payment Tips in the $5 Put Casinos

The remaining $75,100 are attributable to the last 3 household of the year. Through the those individuals house, Deprive spent some time working 150 months inside Singapore and you may 1 month in the You. Rob’s occasional overall performance out of functions in the united states did not cause distinctive line of, separate, and you may continued amounts of time. For the $75,one hundred thousand, $12,five hundred ($75,100 × 30/180) is actually U.S. source earnings. If you are submitting the amended get back in response to a asking see you received, you’ll continue to discover billing observes up to your own amended tax return is accepted.

For more information on when you should document and you may where to file, discover chapter 7. This can be genuine even though your revenue is excused of U.S. income tax due to a tax treaty, consular agreement, or global contract. Occasionally, your don’t have to report the funds in your Mode 1040 or 1040-SR because the income would be excused out of U.S. https://mrbetlogin.com/dr-fortuno/ income tax below an excellent treaty. Enter the count in which treaty benefits is stated, inside parentheses, to the Plan 1 (Form 1040), range 8z. Get into “Exempt money,” the name of one’s pact nation, as well as the treaty article giving the fresh different. Citizen aliens basically don’t be eligible for tax pact advantages since the very taxation treaties contain a great “rescuing term” one preserves or “saves” the right of one’s All of us so you can income tax the residents and residents because if the fresh income tax pact had not have been in impact.

Withholding to the Tip Income

Practical trigger is believed whenever 90% of the taxation shown for the return are paid back because of the new due date of your get back. If, just after April 15, 2024, you see that your estimate from tax due is as well lowest, pay the additional tax immediately to stop otherwise remove next buildup away from charges and you may desire. Stick to the tips lower than to find the degree of an excessive amount of SDI to go into to your Setting 540, line 74.

Key Characteristics

The new metropolitan commuter transport mobility taxation (MCTMT) are implemented to the mind-functioning individuals with net money out of thinking-a job used on Urban Commuter Transport District (MCTD). Contact the newest mutual fund more resources for conference the brand new fifty% investment demands and figuring your allowable subtraction (if any). When you have finished Setting It-225, transfer the fresh numbers to make They-203 as instructed to the Function It-225.

- To recover 100% of the security deposits, make sure to get photographs of your after the parts (and you will put reviews to the video clips of any space).

- Attach federal Form 8886, Reportable Deal Revelation Declaration, to the right back of the California taxation return and one almost every other supporting times.

- Get into you to definitely the main government amount which you gotten because the an excellent nonresident out of a business, change, or career your continued inside New york State.

If your business is formed below three years through to the statement, have fun with the total gross income from the time it absolutely was shaped. Influence the brand new region that is You.S. resource earnings by multiplying the brand new bonus from the following the tiny fraction. Bob and you will Sharon Williams try hitched and you will they are both nonresident aliens at the beginning of the year. Within the Summer, Bob turned a citizen alien and you may stayed a citizen on the rest of the 12 months. Bob and you will Sharon one another prefer to get addressed while the resident aliens because of the checking the proper package to the Mode 1040 or 1040-SR and attaching a statement to their mutual get back.

Married/RDP Submitting Independently

Opinion the brand new guidelines to possess Mode It-216 and you will, for those who qualify, done Function They-216 and import the quantity from Mode They-216 to form It-203, line 52. When you’re susceptible to some other taxes, complete the appropriate forms and you may Area dos out of Mode They-203-ATT. Transfer the amount of Setting It-203-ATT, line 33 Net almost every other Nyc State fees, so you can line 49. If the Internal revenue service is calculating the federal made money borrowing, create EIC from the container to the left of your own currency line and leave the cash line empty online 43. You need to over Form They-203, traces forty five, 47, 49, 51 due to 57, and you can 60 because of 65, but don’t complete traces 66 due to 71.

You might only deduct an excellent nonbusiness casualty otherwise thieves losses if the it’s attributable to a great federally declared emergency. You can even qualify for the fresh exception revealed prior to if you satisfy each of the next requirements. You could qualify for the fresh exemption explained over if all of another use. For many who expatriated after Summer 16, 2008, you are treated as the a secure expatriate, as well as the expatriation regulations lower than area 877A apply at your if the you meet any of the after the criteria. Your expatriation go out is the day your relinquish U.S. citizenship (in the example of an old resident) otherwise cancel their a lot of time-term abode (when it comes to an old You.S. resident). Writeup on your own get back the amount of OID revealed to your Setting 1042-S if you ordered your debt software at the unique thing.