By giving diversified, consistent connection with a particular stock style, for each ETF is organized in order that people can potentially utilize them because the foundations inside developing its a lot of time-identity asset allotment. A line of Fidelity ETFs will let, from the combining the big information of a group of effective guarantee executives. And so they’re being offered to the prospective tax efficiencies and you will aggressive rates you to definitely buyers have come to anticipate of ETFs. Of course, of a lot people don’t feel the date otherwise inclination to invest its months looking thanks to annual account, so they entrust that it try to top-notch financing executives—individuals who real time and you will inhale inventory investigation. So it issue is not designed as the an advice, provide or solicitation to your pick otherwise selling of any protection or funding method. Merrill also offers an over-all listing of broker, money advisory or any other functions.

Register with IQ Option | Drawbacks out of ETFs

At the same time, of many robo-advisers play with ETFs within profile framework process. For individuals who unlock a free account with an excellent robo-coach, they’ll most likely invest in ETFs for you playing with very first profile theories to put together an investing plan for you founded in your desires and you will risk tolerance. You can also be energized brokerage profits to help you trading ETFs, based on and this agent you utilize to purchase market shares. Before carefully deciding to purchase an enthusiastic ETF, verify what fees will be inside.

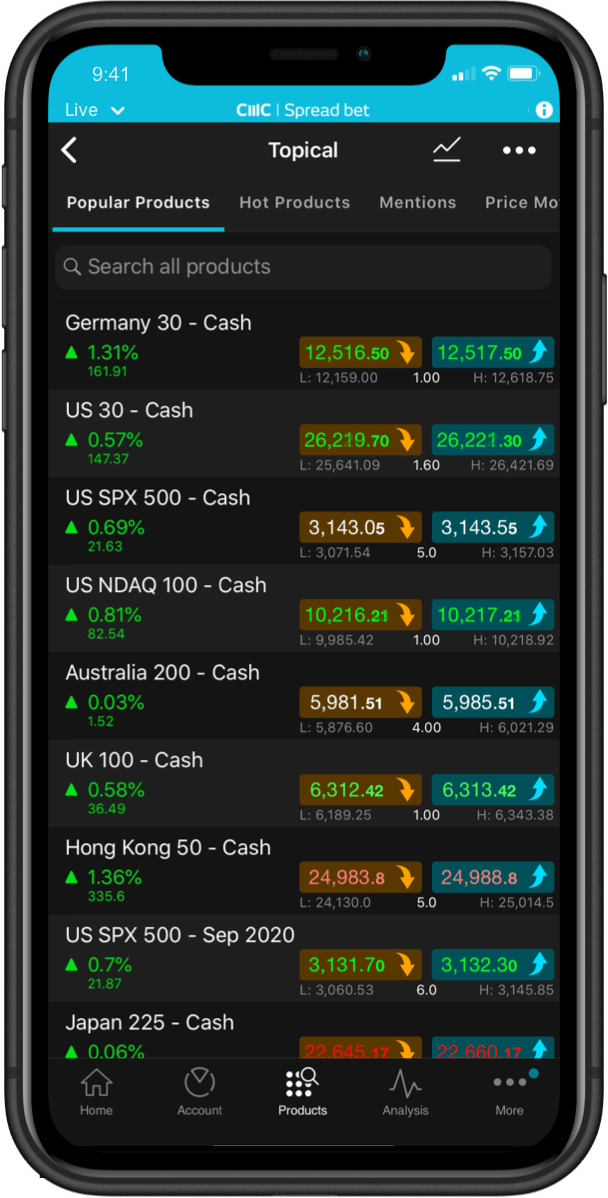

The higher the fresh fee more dictate those individuals top 10 holdings will get along the ETF. Our next part is key quotation details, that’s fundamentally suggestions you might have within quotation part, including the quote & query rates and you can proportions, the brand new day of diversity and the large and you may reduced throughout the day and finally the newest 52-week diversity. Own enterprises from a given proportions, normally both small, typical or large. Here are a few of the very most preferred ETF categories and you will just what it are.

Such hold you to definitely type otherwise multiple ties, taking buyers that have contact with repaired-money ties. There are a few subcategories out of bond ETFs, for each targeting different varieties of securities. Bodies thread ETFs purchase Treasurys or other regulators securities, providing experience of personal debt awarded by the national governments. ETPs you to tune a single industry otherwise item can get showcase also better volatility. Particular directory of passive ETFs seek to track market indexes and you may signs, providing investors a method to mimic the newest performance of these benchmark. ETFs is listed on public transfers, and you will purchase and sell her or him during the field occasions simply including brings.

Usually do not skip the possible opportunity to probably position their portfolio to possess extreme progress – obtain the 100 percent free content today Register with IQ Option . Our very own pros provides identified 7 Zacks Review #step 1 Solid Purchase carries poised for possible breakout in the coming days. After you cook all of it off, Bitcoin ETFs draw a huge step up digital currency expanding upwards and you may connecting with dated-college or university financing.

How do i Purchase ETFs?

As the futures stored by the money roll over, there is certainly times when the ETF notices steep, abrupt losings. The fresh procedures talked about try purely to have illustrative and you will educational objectives and you will are not a recommendation, render otherwise solicitation to shop for otherwise offer people securities or even to embrace people investment method. There is no make sure that one tips discussed will be effective. List performance will not mirror people administration fees, transaction can cost you or expenses. Zero exclusive technical otherwise advantage allotment model is actually a guarantee against loss of prominent.

When you’re generally shorter volatile than simply common inventory, common inventory ETFs will likely be sensitive to alterations in rates. Preferred Stock ETF (PFF), and this retains a collection of diverse U.S. well-known carries. It offers possessions around $15 billion, a cost proportion of 0.46%, and four-year production away from step 3.01%. This type of explore alternatives tricks for possible earnings generation, downside security, or magnified production compared to traditional index-tracking investment.

Some work with mature and you will gains-centered locations, enabling you to diversify away from country’s limitations. These types of ETF for example appeals to those individuals seeking to decrease country-specific dangers and capitalize on candidates inside foreign segments. Including, if you were looking for wearing connection with specific European carries from Austrian industry, you might think about the iShares MSCI Austrian Index finance (EWO). These types of finance was putting on share of the market one of people trying to create socially in control assets. It implement ESG standards to pick brings, planning to invest in businesses that have responsible practices.

The Simple ETFs on the market today follow an identical investment strategy. Each one begins with certain advantage category, such highest-limit well worth holds, or growing-industry holds. A team of Fidelity financing executives just who spend money on you to asset class is chosen—that have an emphasis for the presenting professionals that have diverse ways and perspectives, as well as strong tune details. The brand new ETFs’ profiles are made playing with a medical procedure that means for each director’s large-belief details, by contrasting the holdings facing their respective directory. You use just one ticker to trading control within the a great curated directory of carries (or other property) and you can enjoy the newest perks of instant variation. In some instances, the fresh investment firm behind the scenes now offers a shared money variation and you can an enthusiastic ETF alternative recording a comparable market directory.

Inexpensive

Subsequently, he has grown enormously and stay an incredibly preferred investment alternatives utilized by traders and you can investors around the world. Including, an investor holding a big condition in the a certain field you will buy an inverse ETF to guard up against possible declines in this field. Inverse ETFs are created to relocate the alternative guidance away from the brand new index it track. ETF financing sponsors work on registered professionals (APs) — usually large representative-traders — whom choose the root bonds that define the fresh ETF.

An alternative are an economic by-product that delivers the buyer the newest proper, however the obligation, to find otherwise offer a main advantage in the a particular rates, known as the strike rates, to the otherwise ahead of a specific date. Phone call alternatives give the manager the authority to get a secured asset from the strike rate in this a particular time. Put options give the owner the right to promote the root investment from the strike rate within this a certain time. These purchase a collection from REITs, providing you with exposure to the actual property field without having to pick services personally. The new REITs whose shares the newest finance keeps generally generate income due to rental room and you will meeting rents, which they next distribute to investors while the dividends. REIT ETFs are popular for their possibility to provide secure money and you can diversification benefits, while the a property usually moves individually of carries and securities.

Endless $0 Investments

These people were accepted under the indisputable fact that futures segments be controlled which means that offer higher degrees of trader protection than just spot cryptocurrency places. In addition to delivering greater variation among private carries, groups, and you can marketplaces, this type of ETFs are designed to offer diversity certainly managers, points of view, and you can spending means. Prior to using think carefully the fresh investment expectations, threats, and you may costs and you will expenses of your fund, and administration charge, almost every other costs and special risks.

You typically only understand an increase (otherwise a loss of profits) when you sell offers of an enthusiastic ETF. To learn the newest wild and you will screws from how that is complete, read the article Into the ETFs. ETFs are very attractive to investors inside highest part because they also provide a means to get a probably varied financing.

ETFs might be structured to track from the cost of a commodity to a big and varied distinct carries—actually certain financing tips. Some ETFs are available to buyers to have earnings generation, conjecture, otherwise hedging exposure inside the an investor’s profile. The initial ETF in the U.S. are the brand new SPDR S&P five hundred ETF (SPY), and therefore tracks the fresh S&P five hundred Index. It song a particular list, including the S&P 500, instead of getting positively treated by the a manager whom purchases and you may offers investment to the finance with the objective from beating field productivity. Index ETFs — just like directory shared fund — make it an easy task to create an incredibly varied profile during the a good affordable.